As marketers had to double-down on creative solutions during the pandemic, change has been happening behind the scenes. Whether it’s doing away with cookies or the recent news that Nielsen’s audience measurement tools are being applied to Twitter’s video content, data use is shifting, always.

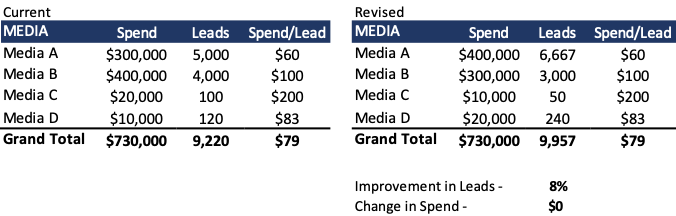

The events of 2020 have a long tail. As marketers enter 2021 with decreased marketing budgets, ROI is of increasing importance. Analytics and the ability to evaluate performance are key, especially as media mix is evolving. And it’s a great time for marketers to check in with their plans and confirm they are still looking at the right metrics.

As companies are finalizing budgets for next year and marketers are fine-tuning their plans, it’s a popular time to look back at what worked and what didn’t. It’s also a critical opportunity to revisit your organizational strategy, realign your KPIs, and design a testing system that gives you actionable insights.

Marketers use many different channels to reach customers, and they’re increasingly building omnichannel strategies that can follow and engage an audience on multiple different platforms. But when it comes to the marketing tools they use, too often these solutions are siloed from one another.

Smart grids and domestic alternative energy production are changing the rules of engagement between energy customers and their suppliers. At the same time, deregulation and a new set of diverse domestic digital media service providers entering the market demand broader and more intelligent marketing strategies. These changes create instability in a market that has been stable for many years. It forces the suppliers, particularly the energy suppliers, to abandon business practices that have long been serving them and adopt a more flexible and agile growth model, an uncomfortable position, particularly for the larger organizations in the sector.

Overview

This three-part series explores various attempts to exploit interactive marketing techniques, defines interactive marketing, and investigates how this new marketing technique recognizes the customer’s role in the customer-company relationship. Part 1 can be found here.

Because marketing automation helps companies run complex campaigns with fewer resources, the software is growing in popularity. According to MarTech, a marketing technology forum, more than 50% of companies currently use marketing automation. 70% of companies, they say, plan to institute it in the next 12 months.

After 7 years of marketing research, Adobe compiled their findings into their Digital Marketing Survey, which turns a spotlight on companies that have achieved digital maturity.

Every year, I look forward to the Retail Dive Awards. This year, Corinne Ruff put together some great categories that sparked a lot of water cooler talk among the Pluris team. While all the categories are discussion-worthy (you can see them here), a few really stood out.

Recently, we spoke about the importance of Increasing Customer Lifetime Value. By optimizing offers for each targeted customer segment, you can improve the conversion rates for your best customers and increase their engagement and purchases.